W2 tax calculator

Employers Tax Professionals Payroll Service Providers Developers. Spouse W2 income annual.

Tax On Wages Calculator Clearance 55 Off Www Ingeniovirtual Com

Lets look at TaxCaster and see how it analyzes your income and key tax factors to.

. Non-owner W2 wages. Whats your W2 salary. See Publication 505 Tax Withholding and Estimated Tax.

Using an online tax refund calculator can show you how much your tax refund will be in advance. Imagine you have 48000 of self-employment income. If you are a high earner a 09 additional Medicare tax may also apply.

With the TurboTax W2 finder you have the option to import your W-2s into TurboTax. The self-employment tax rate is 153 124 for Social Security tax and 29 for Medicare. You have nonresident alien status.

With the HR Block W2 finder your W-2 information can be automatically retrieved and imported into your tax return. A W2 form is also known as a wage and tax statement. Calculate your state income tax step by step 6.

For income tax your business profits are added to any other income like W2 interest and investment income etc and then deductions and adjustments are applied to figure out the income tax. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. The Best Free W2 Finders Online.

Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. You can try it free for 30 days with no obligation and no credt card needed. State Forms are not listed here.

202223 Tax Refund Calculator. Based on the Information you entered on this 2021 Tax Calculator you may need the following 2021 Tax Year IRS Tax Forms to complete your 2021 IRS Income Tax Return. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

The TurboTax TaxCaster is an all-in-one online tax tool that helps you work out a range of tax-related figures. Saskatchewan tax bracket Saskatchewan tax rates Alberta tax bracket Alberta tax rates British Columbia tax bracket British Columbia tax rates Yukon tax bracket Yukon tax rates Northwest Territories tax bracket Northwest Territories tax rates Nunavut tax bracket Nunavut tax rates. If youre confused by tax forms and get your 1099s mixed up with your W2 read on.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Capital Gains Tax Free Allowance. 1099 workers are also known as self-employed workers or independent contractors.

This calculator assumes that all your Social Security taxes were withheld from your salary before calculating your final result. HR Block has been helping. ACA Forms Form 1095-B Form 1095-C ACA Corrections ACA State Filings.

Offer valid for tax preparation fees for new clients only. Pay Estimated Income Tax Online. The 1099 vs W2 distinction is what separates employees from the self-employed.

Underpayment of 2021 Estimated Individual Income Tax. Rather it shows what. You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year.

If you earned less than 40400 total income - so including your crypto - in the 2021 financial year or 41675 in 2022 - youll. Read on to learn more about the W2 generator and see how you can easily create a W2 online. Form 1040 Version.

Get the latest COVID-19 news for your firm. See which two websites have the best tax refund calculators estimators for 2022 2023. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022.

Compare your income and tax situation when you work as a W2 employee vs 1099 contractor. The percentage shown here isnt meant to reflect your actual tax rate. These workers receive a 1099 form to report their income on their tax returns.

2017-2020 Lifetime Technology Inc. Tax Extension Forms Form 8868 Form 4868 Form 7004 Form 8809. Your top income tax rate is 22.

But when it comes to the 1099 vs. Gifting crypto under 15000 or 16000 for 2022. Non Profit Forms Form 990 Series.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Online W4 W9 W8s Form W-4 Form W-9 Free Form W-8BEN. If you want to simplify payroll tax calculations you can download ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you automatically.

These things impact your tax. Pay Estimated Income Tax by Voucher. Your household income location filing status and number of personal exemptions.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. The Entity Selection Calculator is designed for Tax Professionals to evaluate the type of legal entity a business should consider including the application of the Qualified Business Income QBI deduction. A new client is an individual who did not use HR Block office services to prepare his or her 2016 tax return.

Calculator xlsx Annualized Income Installment Method for Underpayment of 2021 Estimated Tax by Individual. Your tax situation is complex. When you prepare your tax return each year your W2 comes in handy as your W2 form displays the amount withheld that would then be subtracted from your taxes.

Annual Spouse monthly income from 1099 contracting freelancing. This calculator is for 2022 Tax Returns due in 2023. American crypto investors can benefit from a few tax free allowances that can help them pay a little less tax on their crypto.

Use this calculator to view the numbers side by side and compare your take home income. 31984 or less. Feeling confident that starting an S Corp is a smart move.

This free tax refund calculator can be accessed online and because you can use the calculator anonymously you can rest assured that your personal information is protected. ESmart Payroll tax software offers online e-filing for IRS forms W2 W2-C 940 941 1099 MISC 1099-C DE9C and corrections. The calculator gives you this result.

Wage Tax Forms Form W-2 Form W-2PR Form W-2c W-2 State Filings. This feature is quick easy and automatically puts your information in the right places on your tax return. W2 Taxes Withheld Adjustments to Income AGI Standard Deduction Itemized Deductions Taxable Income Tax On Income.

Income W2 and expenses and our free tax refund estimator will give you an idea of how much youll get as a tax refund. Use your income filing status deductions credits to accurately estimate the taxes Tax Refund Calculator 2020 RapidTax. Estimate your tax withholding with the new Form W-4P.

This includes alternative minimum tax long-term capital gains or qualified dividends. The self-employment tax applies to your adjusted gross income. W-2 workers are also known as employees.

Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. ESmart Payroll is IRS Authorized. 1099s and W-2s are the tax forms employers use to report wages and taxes withheld for different workers.

When Are Taxes Due In 2022 Forbes Advisor

W4 Vs W2 Vs W9 Vs 1099 Tax Forms What Are The Differences

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Employer Identification Number

Tax Calculator Estimate Your Taxes And Refund For Free

Income Tax Calculator Estimate Your Refund In Seconds For Free

Free Payroll Calculator Cheap Sale 51 Off Www Ingeniovirtual Com

Tax Refund Calculator 2020 Online 50 Off Www Ingeniovirtual Com

How To Calculate 2019 Federal Income Withhold Manually

1 343 W2 Stock Photos Pictures Royalty Free Images Istock

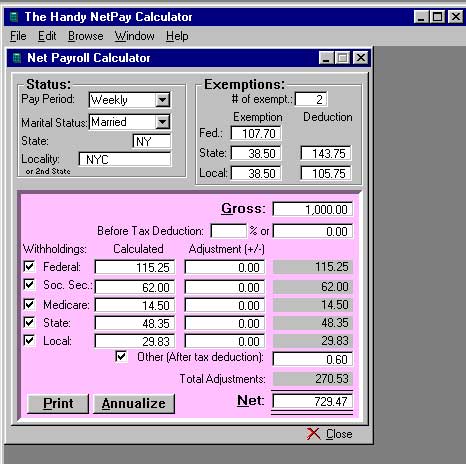

W 2 1099 Filer Software Net Pr Calculator

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

How To Determine Your Total Income Tax Withholding Tax Rates Org

Tax Withholding Calculator For Employers Online Taxes Federal Income Tax Tax

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Taxable Income Formula Examples How To Calculate Taxable Income

Instant W2 Form Generator Create W2 Easily Form Pros

How To Calculate Your Federal Income Tax Refund Tax Rates Org